Green Finance 101: The Rise and Significance of Sustainable Investing

In today’s world, where environmental concerns are at the forefront of global discussions, the concept of “green finance” has gained immense traction. Green finance represents a transformative shift in the financial landscape, focusing not only on economic gains but also on sustainable practices that benefit the planet. This article delves into the fundamental aspects of green finance, exploring its rise, significance, and impact on sustainable investing.

Green finance, at its core, is a financial approach that seeks to reconcile economic development with environmental sustainability. It encompasses a wide range of financial activities and initiatives that support environmentally friendly projects and businesses while fostering a more sustainable future.

Understanding Green Finance

Defining Green Finance

Green finance involves the integration of environmental, social, and governance (ESG) criteria into financial decision-making processes. It promotes investments that contribute to climate mitigation, resource efficiency, and social responsibility.

Core Principles

The principles of green finance revolve around promoting transparency, accountability, and long-term thinking. It encourages financial institutions to consider both the potential risks and rewards of their investments from an environmental and social standpoint.

The Rise of Sustainable Investing

Shifting Mindsets in Finance

Over the past decade, there has been a notable shift in how the financial industry perceives sustainability. Previously considered a niche area, sustainable investing has now become mainstream, driven by the realization that companies with strong ESG performance are more likely to thrive in the long run.

Environmental, Social, and Governance (ESG) Criteria

ESG criteria evaluate a company’s environmental impact, social practices, and corporate governance. These factors provide investors with a holistic view of a company’s overall sustainability and ethical practices.

The Role of Millennials and Gen Z

The younger generations, notably Millennials and Gen Z, are playing a pivotal role in driving the demand for sustainable investments. Their values and priorities have spurred financial institutions to adapt their offerings to align with these preferences.

Significance of Green Finance

Environmental Benefits

Green finance channels funds into projects that contribute to environmental preservation, such as renewable energy, clean technology, and sustainable agriculture. This allocation of capital aids in the transition to a low-carbon economy.

Financial Resilience

Investing in environmentally responsible businesses can lead to improved financial performance. Companies that proactively address environmental risks are better positioned to navigate regulatory changes and market fluctuations.

Positive Social Impact

Green finance extends beyond environmental considerations, also encompassing social and community benefits. Investments in projects that promote clean air and water, as well as fair labor practices, contribute to the overall well-being of society.

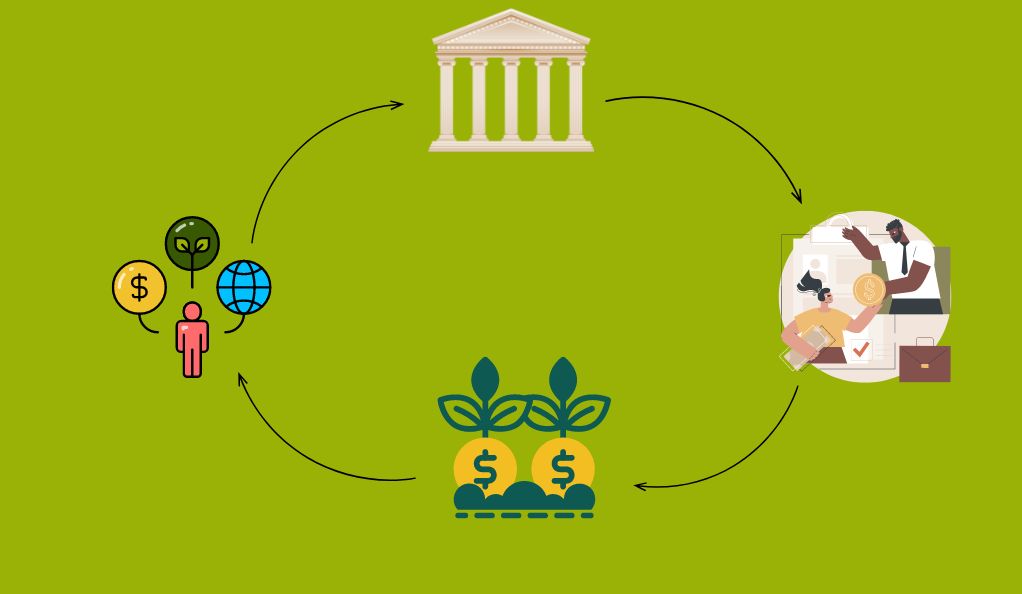

The Role of Financial Institutions

Integrating ESG Factors

Financial institutions are integrating ESG factors into their risk assessment and investment strategies. This approach not only aligns with societal expectations but also enhances the long-term stability of investments.

Green Bonds and Investments

Green bonds are a prominent example of financial instruments that fund environmentally friendly projects. These bonds provide investors with a direct link to sustainable initiatives, while generating financial returns.

Sustainable Lending Practices

Banks and financial organizations are adopting sustainable lending practices by evaluating the environmental impact of loans. This encourages businesses to adopt greener practices to secure funding.

Challenges and Future Prospects

Data Transparency

One challenge facing green finance is the availability and accuracy of ESG data. Transparent and reliable information is crucial for making informed investment decisions.

Regulatory Frameworks

The establishment of consistent regulatory frameworks is essential to ensure that green finance maintains its integrity and impact. Harmonized regulations will prevent “greenwashing” and promote genuine sustainability efforts.

Innovation and Technological Advancements

Innovation in financial technology (FinTech) plays a pivotal role in advancing green finance. From digital platforms promoting sustainable investments to blockchain enhancing transparency, technology is reshaping the sector.

How to Get Involved

Individual Investors

Individuals can engage in green finance by investing in funds and portfolios with strong ESG credentials. This allows them to align their financial goals with their values.

Businesses and Corporations

Companies can adopt sustainable business practices that not only benefit the environment but also enhance their reputation and customer loyalty.

Government Initiatives

Governments have a crucial role in incentivizing green finance through policies and regulations that support sustainable investments and penalize unsustainable practices.

The Global Impact

International Collaborations

The impact of green finance goes beyond national borders. International collaborations and agreements are necessary to address global challenges like climate change and resource depletion.

Addressing Climate Change

Green finance is a key player in addressing climate change by redirecting capital towards low-carbon and climate-resilient projects that contribute to reducing greenhouse gas emissions.

Conclusion

In conclusion, the rise of green finance signifies a paradigm shift in the financial landscape. It underscores the interconnectedness between financial success and sustainable practices. As green finance continues to evolve, it presents a unique opportunity to reshape the future of investments, benefitting not only the economy but also the planet.

FAQs

Green finance involves integrating environmental, social, and governance factors into financial decisions to promote sustainability.

ESG criteria assess a company’s environmental impact, social practices, and corporate governance to gauge its sustainability efforts.

The increased awareness of environmental issues and the demand for ethical investments, especially among younger generations, have propelled green finance into the spotlight.

Individuals can invest in ESG-focused funds and portfolios that align with their values and support sustainable initiatives.

Governments play a crucial role in incentivizing green finance through policies that promote sustainable investments and regulations that discourage harmful practices.