The ABCs of Student Loans: Understanding Types, Rates, and Repayment Options

Student loans play a crucial role in helping millions of students achieve their higher education dreams. However, navigating the world of student loans can be complex and overwhelming. In this comprehensive guide, we’ll break down the ABCs of student loans, covering the various types, interest rates, and repayment options available to students.

The pursuit of higher education often comes with a financial cost that can be covered in part by student loans. Understanding the types of loans available, the interest rates attached, and the repayment options can help students make informed decisions about their education financing.

Types of Student Loans

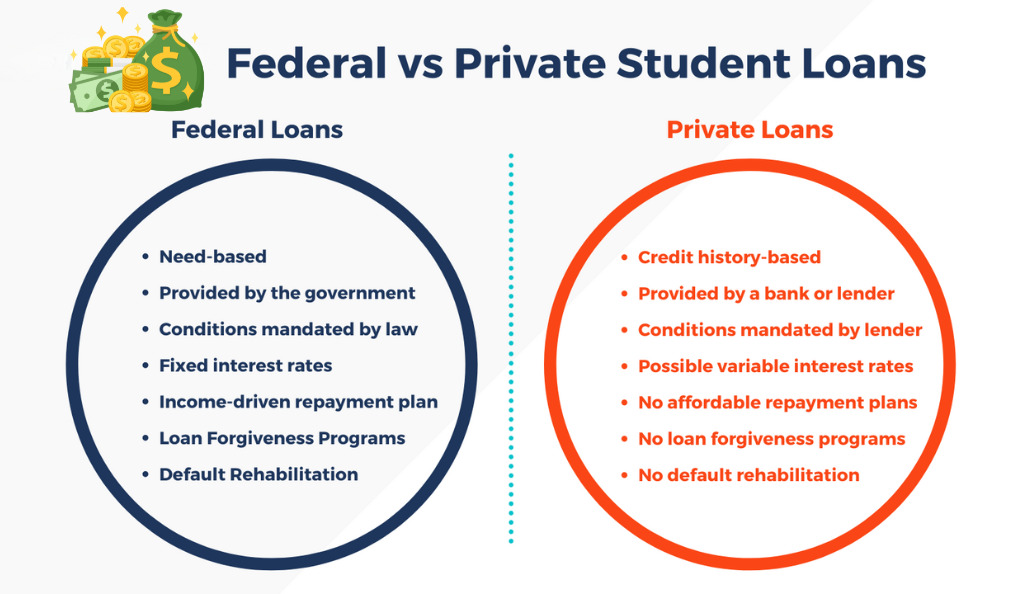

Federal Student Loans

Federal student loans are provided by the government and offer several options for students to finance their education.

- Subsidized Loans

Subsidized loans are based on financial need, and the government pays the interest while the student is in school. This significantly reduces the overall cost of the loan. - Unsubsidized Loans

Unsubsidized loans are available to all students, regardless of financial need. However, students are responsible for paying the interest that accrues during their school years. - PLUS Loans

PLUS loans are designed for parents and graduate students. They cover the remaining cost of education not covered by other financial aid. Interest rates are higher, and credit checks may be required.

Private Student Loans

Private student loans are offered by banks and lending institutions. They are based on creditworthiness and may have higher interest rates compared to federal loans. Private loans can be a solution when federal aid falls short.

Understanding Interest Rates

Interest rates significantly impact the total amount students will repay over the life of the loan.

- Fixed Interest Rates

Fixed rates remain constant throughout the life of the loan, providing predictability in monthly payments. - Variable Interest Rates

Variable rates can change over time, leading to fluctuating monthly payments. These rates may start lower than fixed rates but could increase in the future.

Repayment Options

Standard Repayment Plan

The standard plan involves fixed monthly payments over a set period, usually 10 years. This option offers a straightforward approach but might lead to higher monthly payments.

Income-Driven Repayment Plans

These plans adjust monthly payments based on the borrower’s income and family size. They offer flexibility but may result in longer repayment terms.

Loan Forgiveness Programs

Certain careers, such as public service or teaching, offer loan forgiveness options. After a specified period of service, a portion of the loan may be forgiven.

Choosing the Right Student Loan

Choosing between federal and private loans depends on individual circumstances. Federal loans offer more flexibility in repayment, while private loans may be necessary to bridge financial gaps.

Applying for Student Loans

The application process for federal loans involves filling out the Free Application for Federal Student Aid (FAFSA). Private loans require separate applications and credit checks.

Managing Student Loan Debt

Effectively managing student loan debt involves budgeting, understanding loan terms, and exploring options like deferment or forbearance in times of financial hardship.

Building a Repayment Strategy

Creating a repayment strategy involves considering financial goals, evaluating loan terms, and choosing the most suitable repayment plan.

Financial Tips for Students

- Seek out scholarships and grants before turning to loans.

- Consider working part-time to cover some educational costs.

- Create a budget to manage expenses during school.

- Be mindful of borrowing only what is necessary to avoid excessive debt.

Conclusion

Navigating the world of student loans can be complex, but with the right information, students can make informed decisions about their education financing. Understanding the types of loans, interest rates, and repayment options empowers students to take control of their financial futures.

FAQ’s

Federal loans often offer more favorable terms and repayment options compared to private loans. It’s recommended to exhaust federal loan options before considering private loans.

Yes, certain loan forgiveness programs are available for individuals in specific careers or circumstances. These programs typically require a certain period of service.

To apply for federal loans, you need to fill out the FAFSA (Free Application for Federal Student Aid) form, which is available online.

If you’re struggling to make payments, you might qualify for deferment, forbearance, or income-driven repayment plans. It’s crucial to contact your loan servicer to discuss your options.

Interest rates on federal loans can vary and are set by the government. They may differ based on the type of federal loan and the academic year for which the loan was disbursed.