Banking on the Climate: How Major Financial Institutions are Adapting to a Warming Planet

As global temperatures rise and extreme weather events become more frequent, the financial industry finds itself in uncharted territory. Major financial institutions are no longer just concerned with maximizing profits; they are also grappling with the challenges and opportunities posed by climate change.

The Impact of Climate Change on the Financial Sector

Climate change has introduced a new layer of risk for financial institutions. Increasing occurrences of natural disasters, such as hurricanes and wildfires, can lead to property damage, affecting insurers and property lenders. Additionally, the shift toward a low-carbon economy could potentially strand assets in industries heavily reliant on fossil fuels.

Incorporating Environmental, Social, and Governance (ESG) Factors

Financial institutions are now considering ESG factors in their decision-making processes. ESG criteria assess a company’s performance in areas of environmental sustainability, social responsibility, and corporate governance. This shift in focus is not only driven by ethical considerations but also by the recognition of the financial impact of ESG-related risks.

Green Investments: Funding Sustainable Projects

One way financial institutions are adapting to a warming planet is by channeling funds into environmentally friendly projects. Renewable energy initiatives, sustainable agriculture, and clean technology are gaining attention as potential areas for investment that align with both profit motives and environmental objectives.

Risk Assessment and Management

Assessing climate-related risks is becoming standard practice in the financial industry. Institutions are employing sophisticated models to analyze how different climate scenarios could impact their portfolios. This proactive approach helps them make informed decisions and mitigate potential losses.

Climate-Related Financial Disclosures

Transparency is key. Financial institutions are increasingly disclosing their exposure to climate-related risks and their strategies for managing them. This not only helps investors make informed choices but also puts pressure on companies to improve their environmental practices.

Collaboration and Partnerships

Addressing climate change requires collaboration. Financial institutions are partnering with governments, NGOs, and other stakeholders to develop strategies for a more sustainable future. These collaborations facilitate knowledge sharing and the pooling of resources.

Technological Innovations in Finance and Sustainability

Technology plays a vital role in advancing both finance and sustainability. Fintech innovations are enabling the creation of innovative financial products that support environmentally conscious initiatives. Moreover, technologies like blockchain are enhancing transparency and accountability.

Regulatory Measures and Guidelines

Regulators are recognizing the need for climate-focused regulations. Financial institutions are adapting to changing rules and guidelines that encourage the integration of climate risk assessment into their operations.

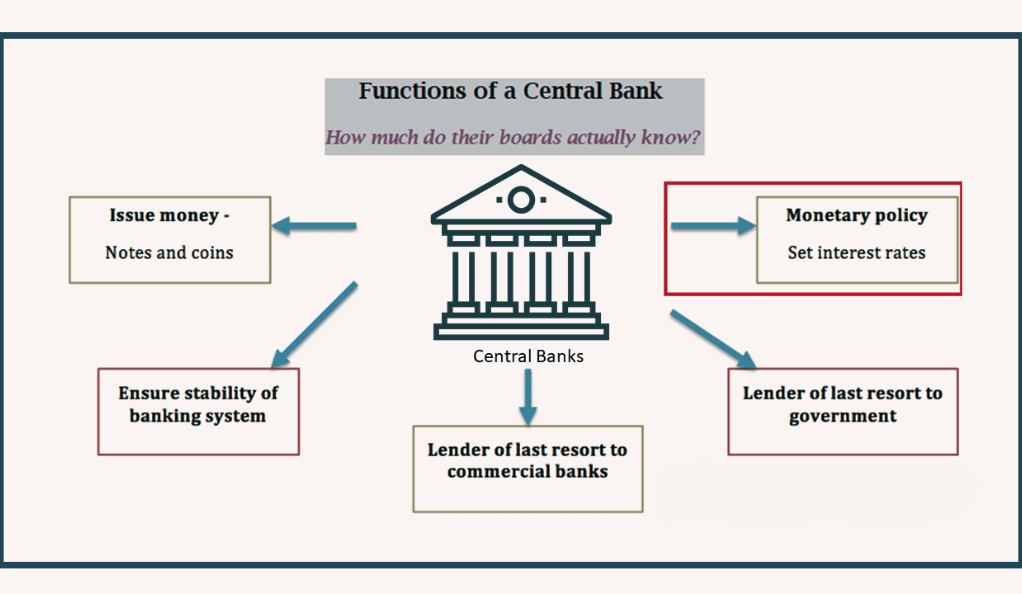

The Role of Central Banks

Central banks are also taking action. Some are incorporating climate considerations into their monetary policy frameworks, reflecting the growing importance of climate-related risks to economic stability.

Public Awareness and Customer Demand

Public awareness of climate change is driving demand for ethical and sustainable financial products. Financial institutions are responding by offering products and services that cater to environmentally conscious customers.

Barriers to Change

Despite progress, obstacles remain. Transitioning to a more sustainable financial system presents challenges such as accurately pricing climate risks, overcoming short-term profit pressures, and navigating complex global dynamics.

The Road Ahead: Long-Term Strategies

The journey toward a climate-resilient financial industry requires long-term strategies. Adapting to a warming planet demands continuous innovation, collaboration, and a commitment to balancing financial and environmental goals.

Conclusion

Major financial institutions are no longer bystanders in the face of climate change; they are active participants in shaping a sustainable future. By embracing ESG principles, investing in green initiatives, and transparently addressing climate risks, these institutions are paving the way for a more resilient and environmentally conscious financial sector.

FAQs

Financial institutions are concerned about climate change because it introduces new risks that can impact their portfolios and operations.

ESG criteria assess a company’s performance in environmental, social, and governance areas.

Financial institutions are investing in sustainable projects and creating innovative financial products that align with environmental objectives.

Climate-related financial disclosure helps investors make informed decisions and encourages companies to improve their environmental practices.

Financial institutions face challenges such as accurately pricing climate risks, managing short-term profit pressures, and navigating complex global dynamics.