Real Estate Investing: Building Wealth Beyond Traditional Means

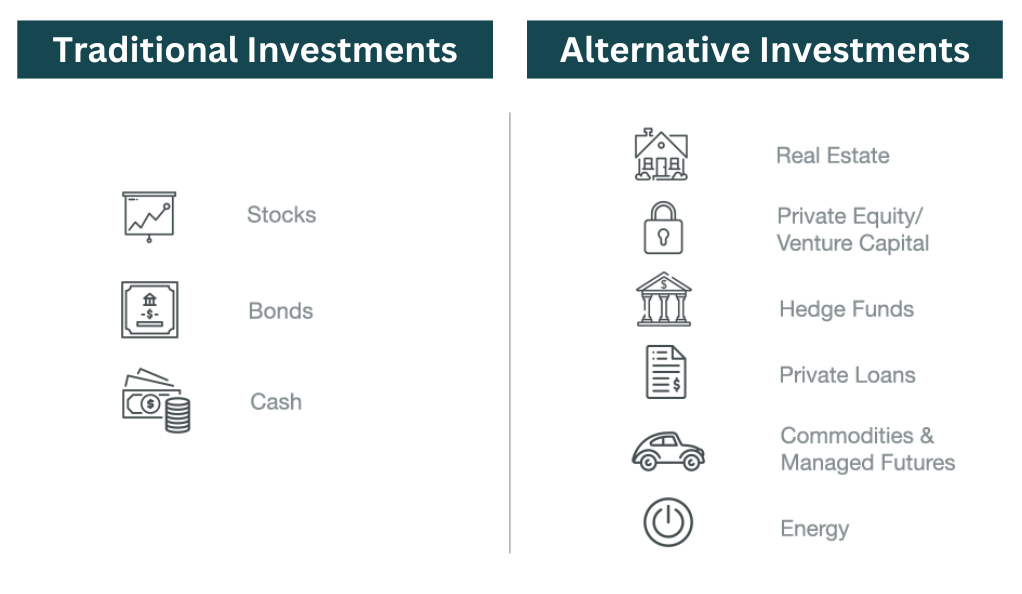

Real estate, often considered the cornerstone of wealth-building, has been a preferred investment choice for centuries. Unlike stocks or bonds, real estate is tangible, offering investors a sense of security and control over their investments. The allure of property, whether it’s residential, commercial, or industrial, lies in its dual potential: to generate rental income and appreciate in value over time.

Moreover, real estate investing offers a hands-on approach. Investors can directly influence their returns by improving properties, adjusting rent prices, or changing lease terms. This direct control is something that traditional stock market investments often lack, making real estate an attractive option for those who want a more active role in their financial growth.

Why Real Estate Over Traditional Investments?

Real estate stands out as a unique investment opportunity for several reasons. Firstly, it’s a tangible asset. Unlike stocks or bonds, you can touch, see, and utilize your investment. This tangibility can provide a psychological comfort to investors, knowing they own something concrete.

Secondly, real estate offers diversification. While the stock market can be volatile, real estate often remains more stable, acting as a hedge against market fluctuations. Additionally, properties can provide a steady stream of passive income through rentals. This income, combined with potential tax benefits like depreciation and mortgage interest deductions, makes real estate a compelling choice over traditional investment avenues.

Types of Real Estate Investments

When it comes to real estate, there’s a plethora of options available for investors.

- Residential Properties, for instance, encompass single-family homes, apartments, townhouses, and vacation rentals. These properties are primarily used for living purposes, and investors earn through rental income and property appreciation.

- Commercial Properties are another avenue. This category includes office buildings, retail spaces, and warehouses. Unlike residential properties, commercial spaces often have longer lease terms, which can provide a more stable and predictable income.

- Industrial Real Estate, like factories and distribution centers, offers unique leasing opportunities and can be lucrative.

- Raw Land is a more speculative investment. Investors buy land with the intention of selling it to developers or using it for specific purposes, such as agriculture or housing developments.

Risks and Rewards of Real Estate Investing

Every investment comes with its set of challenges, and real estate is no exception

- Risks in real estate include market fluctuations that can affect property values, potential property damage from natural disasters or accidents, problematic tenants, and unforeseen maintenance costs. It’s essential for investors to be aware of these risks and to have strategies in place to mitigate them.

- Rewards of real estate can be substantial. Beyond the potential for consistent rental income, real estate often appreciates in value over time, leading to significant capital gains when selling. Additionally, there are numerous tax benefits associated with real estate, from depreciation to potential deductions on mortgage interest, which can enhance overall returns.

Strategies for Successful Real Estate Investment

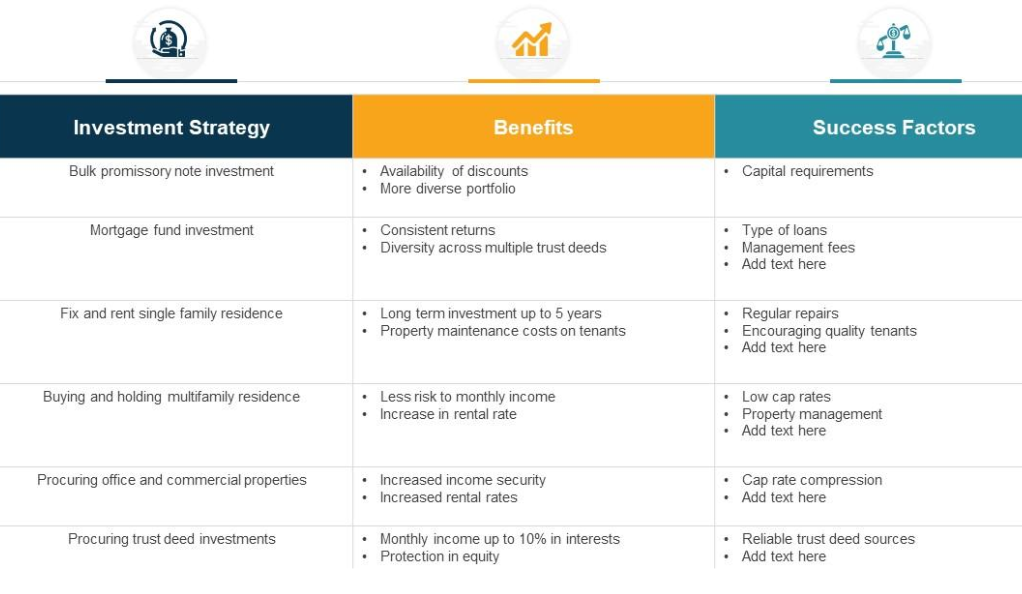

Success in real estate requires more than just capital; it demands strategy.

- Research is paramount. Investors should understand the local market, property values, and rental rates to make informed decisions. Knowledge of local regulations and laws is also crucial to avoid potential legal pitfalls.

- Diversification is another key strategy. Just as with traditional investments, it’s unwise to put all your eggs in one basket. Investing in different types of properties or in various geographic locations can spread risk.

- Networking with real estate professionals, from agents to seasoned investors, can provide invaluable insights and opportunities.

- Long-term Perspective is vital. Real estate isn’t typically a get-rich-quick scheme. Patience, combined with strategic planning, can yield significant rewards.

Conclusion

Real estate investing, with its tangible assets and potential for both passive income and capital appreciation, offers a unique blend of security and growth. While it’s not without its challenges, the rewards can be substantial for those willing to put in the time, effort, and research. By understanding the market, diversifying investments, and leveraging professional networks, investors can navigate the world of real estate with confidence, building wealth beyond traditional means.

FAQs

Real estate is often seen as a stable and tangible asset that can provide passive income through rentals and appreciate in value over time. Additionally, it offers tax benefits and acts as a hedge against inflation.

The initial amount varies based on the property type and location. Some investors start with just a few thousand dollars in REITs, while others might need significant capital for direct property purchases.

Yes, Real Estate Investment Trusts (REITs) allow individuals to invest in real estate without owning physical property. They can be traded like stocks and offer a way to diversify into real estate.

Risks include market downturns, property damage, tenant issues, and unexpected maintenance costs. However, thorough research and due diligence can mitigate many of these risks.

Consider factors like location, property condition, local rental rates, and potential for appreciation. Networking with local real estate professionals can also provide insights into the best investment opportunities.