Private Equity 101: Understanding the Basics and Benefits

Private equity refers to investments made in privately-held companies that are not publicly traded on stock exchanges. It involves investing capital into these companies to acquire ownership stakes, often with the intention of facilitating growth, improving operations, and eventually realizing profits.

How Private Equity Works

Private equity firms raise funds from institutional investors and high-net-worth individuals. These funds are then pooled together to create a sizable capital pool. The firms use this capital to invest in various companies across different sectors.

Different Stages of Private Equity Investment

Private equity investments occur in different stages:

- Venture Capital: Early-stage funding for startups.

- Buyouts: Acquiring a controlling stake in established companies.

- Expansion Capital: Funding for companies looking to expand operations.

- Distressed Investing: Investing in financially troubled companies.

Key Players in Private Equity

The key players in private equity include:

- Limited Partners (LPs): Investors who provide capital to private equity firms.

- General Partners (GPs): Firms responsible for managing the invested capital.

- Portfolio Companies: Companies that receive investment from private equity funds.

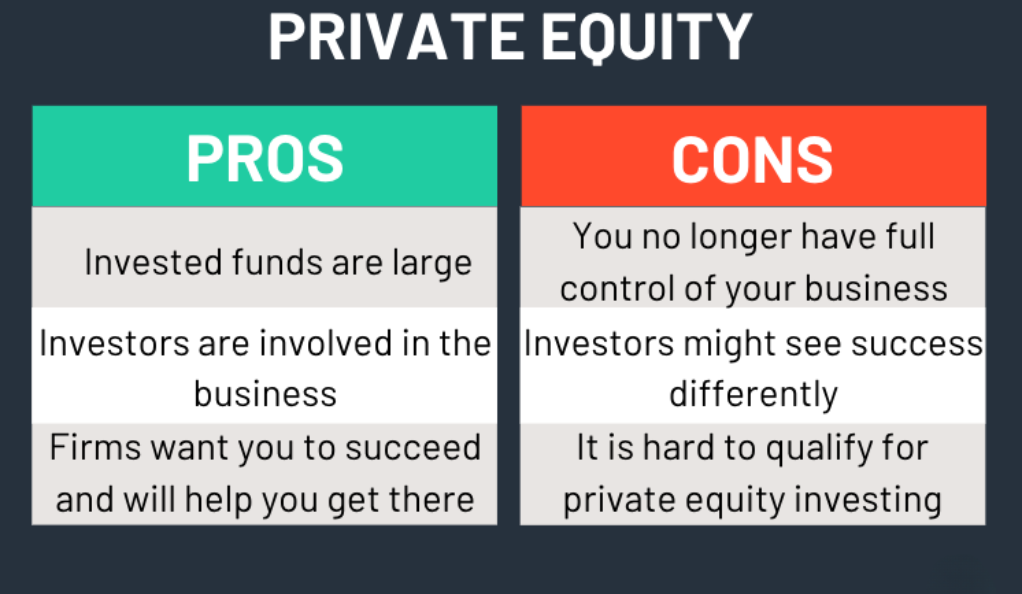

Advantages of Private Equity Investment

Private equity offers several benefits:

- Active Management: Private equity firms actively work to enhance the value of their investments.

- Higher Returns: Historically, private equity has delivered higher returns compared to traditional investments.

- Long-Term Perspective: Private equity investments are typically long-term, allowing for strategic growth.

Challenges and Risks

Despite its advantages, private equity also comes with risks:

- Liquidity Risk: Investments are not easily sold, leading to limited access to funds.

- Market Fluctuations: Economic downturns can impact the valuation of portfolio companies.

Private Equity vs. Venture Capital

Private equity and venture capital are often confused. While both involve investing in companies, venture capital focuses on startups, whereas private equity deals with more mature companies.

Private Equity’s Influence on Startups

Private equity has started playing a larger role in startup funding, offering resources for scaling operations and accelerating growth.

Private Equity in Real Estate

Private equity plays a significant role in real estate development, offering financing for projects and property acquisitions.

Private Equity in Healthcare

Private equity investments in healthcare aim to improve medical services, technology, and patient care.

Private Equity in Technology

The technology sector benefits from private equity investments that support innovation, research, and development.

Ethical Considerations in Private Equity

The ethical implications of private equity investments are a topic of debate, with concerns about labor practices and corporate governance.

Measuring Private Equity Success

Success in private equity is measured through metrics such as internal rate of return (IRR) and return on investment (ROI).

Future Trends in Private Equity

Future trends may include increased ESG (Environmental, Social, and Governance) considerations and more diverse investment strategies.

Conclusion: Unlocking Opportunities Through Private Equity

Private equity offers a unique avenue for investors to support companies’ growth and development. By understanding its nuances, risks, and potential rewards, investors can make informed decisions that align with their financial goals.

FAQs

Private equity involves investing in privately-held companies to acquire ownership stakes and facilitate growth.

Private equity firms raise funds from institutional investors and high-net-worth individuals.

Private equity investments include venture capital, buyouts, expansion capital, and distressed investing.

Private equity offers active management, higher returns, and a long-term investment perspective.

Liquidity risk and market fluctuations are common risks associated with private equity investments.