Demystifying Crop Insurance: A Comprehensive Guide for Farmers

Farming is a crucial element of our economy, but it comes with its share of uncertainties. From unpredictable weather patterns to pests and diseases, farmers face numerous challenges that can jeopardize their crop yield and financial stability. This is where crop insurance steps in as a safeguard, providing farmers with a safety net against potential losses. In this comprehensive guide, we’ll delve into the world of crop insurance, breaking down its types, benefits, eligibility criteria, and how farmers can make the most out of this vital risk management tool.

Understanding Crop Insurance

What is Crop Insurance?

Crop insurance is a risk management tool designed to protect farmers from financial losses resulting from crop damage or yield reduction due to various factors such as adverse weather conditions, pests, diseases, and market fluctuations. It provides a safety net that enables farmers to recover some of their losses and maintain their livelihoods even in the face of unexpected challenges.

Why is Crop Insurance Important?

For farmers, their crops are not just plants; they are investments of time, effort, and resources. Crop insurance offers a way to mitigate the uncertainties that can threaten these investments. It provides peace of mind by offering financial compensation when factors beyond a farmer’s control impact their crop yields.

Types of Crop Insurance

Yield-Based Insurance

Yield-based insurance, also known as yield insurance or yield protection, focuses on safeguarding against losses in crop yield. It pays out when the actual yield falls below a predetermined yield guarantee due to covered perils.

Revenue-Based Insurance

Revenue-based insurance, also referred to as revenue protection, addresses not only yield losses but also changes in crop prices. It provides coverage for scenarios where the combination of yield and market price fluctuations leads to reduced revenue.

Area-Based Insurance

Area-based insurance, often used for larger regions, offers coverage based on the overall yield or revenue of a specified area, rather than individual farms. It takes into account the average performance of the area, providing protection against widespread losses.

Eligibility and Enrollment

Who Qualifies for Crop Insurance?

Most crop insurance programs cater to a wide range of farmers, including those with small and large operations. Eligibility criteria may vary based on factors such as the type of crops grown, location, and historical production records.

Enrollment Process and Deadlines

Farmers typically need to enroll in crop insurance before the planting season begins. It’s essential to be aware of enrollment deadlines to ensure you have coverage for the upcoming growing season.

Coverage and Claims

What Does Crop Insurance Cover?

Crop insurance covers a variety of perils, including weather-related events (such as droughts, floods, and hail), disease outbreaks, pest infestations, and sometimes even market price fluctuations.

Filing a Crop Insurance Claim

If your crops suffer losses due to covered perils, you need to file a claim with your insurance provider. This involves providing documentation, such as production records and proof of losses, to support your claim.

Selecting the Right Coverage

Analyzing Your Farm’s Risks

Before choosing a crop insurance policy, it’s essential to assess the specific risks your farm faces. Factors like geographic location, climate conditions, and historical yield data play a crucial role in determining the most suitable coverage.

Consultation with Crop Insurance Agents

Crop insurance agents are valuable resources when selecting coverage. They can provide insights into policy options, help analyze risks, and guide you toward a policy that aligns with your farm’s needs.

Premiums and Subsidies

Calculating Premium Costs

The premium cost of crop insurance depends on factors such as coverage level, historical yields, and the type of insurance chosen. It’s crucial to calculate these costs accurately to understand the financial implications.

Government Subsidies and Support

Many governments offer subsidies to farmers to make crop insurance more affordable. These subsidies aim to encourage farmers to participate in risk management programs, ensuring the stability of the agricultural sector.

Understanding Indemnity

How Indemnity Payments Work

Indemnity payments are the compensation you receive from your insurance provider when a covered loss occurs. They are calculated based on factors like the insured crop’s yield, the guaranteed yield, and the crop’s market price.

Indemnity vs. Actual Losses

It’s important to note that indemnity payments may not cover all your actual losses. They are designed to help you recover a portion of your losses and stabilize your financial situation after a covered event.

Crop Insurance Myths Debunked

Myth 1: Crop Insurance is Only for Large Farms

Crop insurance is beneficial for farms of all sizes. Small and medium-sized farms can also benefit from the financial security and stability that crop insurance provides.

Myth 2: Crop Insurance Guarantees Profits

While crop insurance offers protection against losses, it doesn’t guarantee profits. It helps farmers recover a portion of their losses, but the success of your farm still depends on various factors beyond insurance coverage.

Maximizing Crop Insurance Benefits

Implementing Risk-Reducing Practices

Alongside crop insurance, implementing risk-reducing practices like crop rotation, pest management, and soil health improvement can further protect your farm from potential losses.

Keeping Detailed Records

Maintaining accurate records of your farm’s production, inputs, and practices is crucial for filing successful insurance claims. Detailed records provide evidence of your losses and support your claim.

Future of Crop Insurance

Technological Advancements in Crop Insurance

The field of crop insurance is evolving with technological innovations. Remote sensing, satellite imagery, and data analytics are being used to assess and predict risks more accurately.

Climate Change and Crop Insurance

As climate change brings about more extreme weather events, crop insurance will play an increasingly important role in helping farmers adapt to changing conditions and protect their livelihoods.

Common Terminology Explained

- ACI (Actual Crop Insurance)

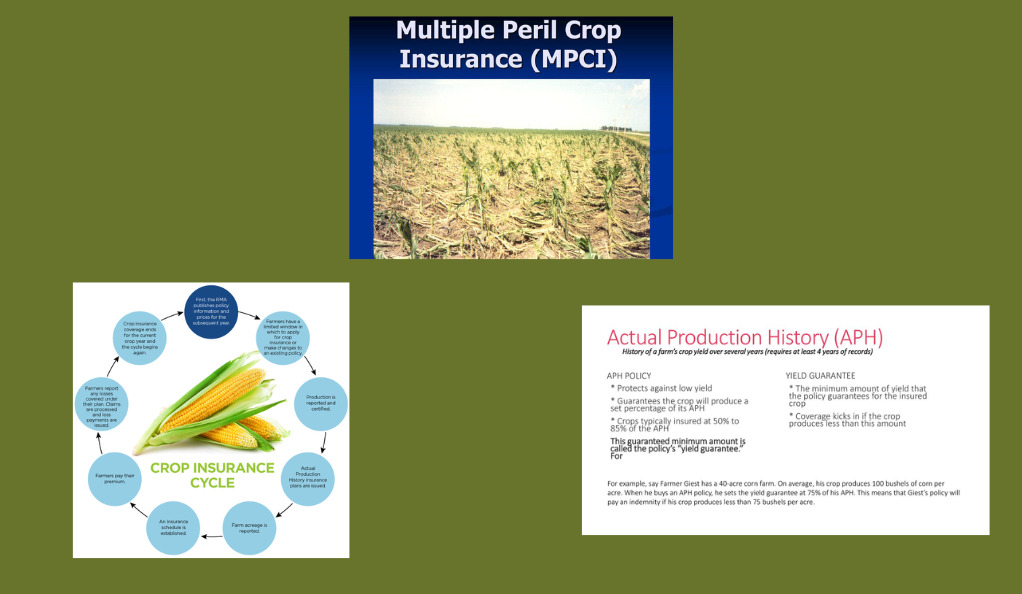

ACI refers to the insurance coverage that compensates for actual crop losses due to covered perils, such as adverse weather or pest infestations. - MPCI (Multi-Peril Crop Insurance)

MPCI provides coverage for multiple perils that could impact crop yield or revenue. It’s a comprehensive type of crop insurance that offers broader protection. - APH (Actual Production History)

APH is a historical record of your farm’s actual crop yields over time. It’s used to calculate the guaranteed yield and determine insurance payouts.

Case Studies

Farmer Success Stories with Crop Insurance

Numerous farmers have benefited from crop insurance during times of adversity. Real-life success stories showcase how crop insurance helped them recover and continue their farming operations.

Lessons Learned from Crop Insurance Cases

Studying past crop insurance cases can provide valuable insights into effective risk management strategies, helping farmers make informed decisions about their coverage.

Comparing Crop Insurance Providers

- Key Considerations in Choosing Providers

When selecting a crop insurance provider, factors such as their reputation, customer service, and the range of coverage options they offer should be taken into account. - Customer Reviews and Reputation

Reading customer reviews and assessing the provider’s reputation in the agricultural community can give you a better understanding of their reliability and commitment to their policyholders.

Making Informed Decisions

- Taking Your Time in Selection

Choosing the right crop insurance policy requires careful consideration. Take your time to evaluate your farm’s needs, consult with experts, and compare different options before making a decision. - Understanding Policy Documents

Thoroughly read and understand the terms and conditions outlined in your chosen policy. Clarify any doubts with your insurance agent to ensure you know exactly what is covered and how to file a claim if needed.

Conclusion

Crop insurance acts as a vital safety net for farmers, providing financial protection against the unpredictable nature of agriculture. By understanding the different types of insurance, the enrollment process, and how to make the most of your coverage, farmers can safeguard their investments and secure their future even in the face of adversity.

FAQs

No, crop insurance policies can be tailored to fit the specific needs of each farm, considering factors such as crop types, location, and historical yields.

No, there are specific enrollment periods and deadlines before each planting season. It’s important to be aware of these deadlines and plan accordingly.

Crop insurance typically covers losses due to covered perils, such as adverse weather or pests. Losses resulting from poor farming practices may not be eligible for compensation.

Coverage changes might be allowed within certain windows before the planting season begins. Consult with your insurance agent to explore your options.

Research online, ask fellow farmers for recommendations, and consider reading customer reviews to identify crop insurance providers with a good track record of customer satisfaction.