Making Sense of Irrationality: Exploring the Intersection of Psychology and Finance

In the dynamic world of finance, where numbers, trends, and predictions dominate, it might seem counterintuitive to talk about irrationality. However, the fascinating field of behavioral finance delves into the intricacies of human behavior and its influence on financial decisions. This article takes you on a journey to explore the intriguing intersection of psychology and finance, uncovering the reasons behind seemingly irrational financial choices and the impact of cognitive biases.

When it comes to finance, numbers and logic often take center stage. However, human beings are inherently emotional and prone to cognitive biases that can significantly sway their financial decisions. The emerging field of behavioral finance recognizes the impact of psychology on investment choices and market behavior.

Behavioral Finance: The Marriage of Psychology and Finance

Behavioral finance bridges the gap between traditional finance theories and the realities of human behavior. It acknowledges that individuals do not always act rationally or make decisions based solely on information. Instead, emotions, cognitive biases, and social influences play a vital role in shaping financial choices.

This section delves deeper into the foundational principles of behavioral finance, exploring the reasons behind its emergence and its implications for the field of finance. By recognizing the significance of this interdisciplinary approach, we can begin to unravel the mysteries of seemingly irrational financial decisions and gain insights into how human psychology and financial markets interact.

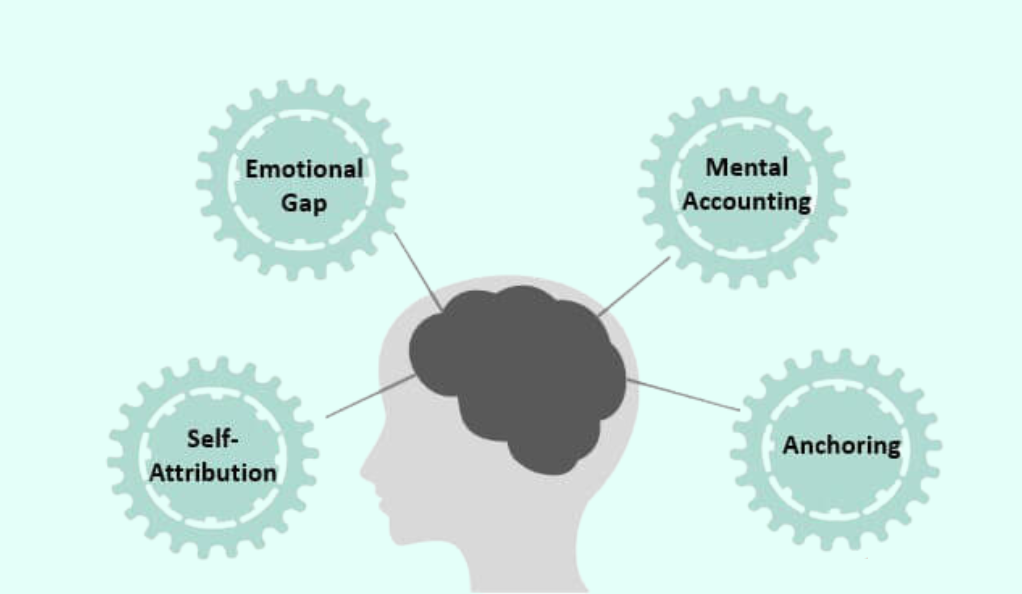

Cognitive Biases: Unraveling the Web of Irrational Choices

Loss Aversion: The Fear of Losing Trumps Gains

Loss aversion is a cognitive bias where individuals feel the pain of losses more intensely than the joy of gains. This tendency can lead to irrational decisions, such as holding onto losing investments longer than necessary.

In this section, we’ll delve into the psychological underpinnings of loss aversion, exploring why humans are wired to react strongly to losses and how this bias can impact investment strategies. By understanding the mechanics of loss aversion, we can gain valuable insights into how to navigate this common pitfall.

Confirmation Bias: Seeing What You Want to See

Confirmation bias involves seeking out information that aligns with pre-existing beliefs while ignoring contradictory evidence. In finance, this can result in skewed analysis and poor decision-making.

In this segment, we’ll examine the psychological mechanisms behind confirmation bias and its effects on financial decision-making. By recognizing the prevalence of this bias, investors and analysts can adopt strategies to mitigate its impact and make more objective judgments.

Overconfidence Effect: The Perils of Overestimation

Overconfidence can lead investors to overestimate their knowledge and underestimate risks. This bias contributes to excessive trading and unrealistic expectations.

This part of the article explores the overconfidence effect in detail, shedding light on why individuals tend to overestimate their abilities in financial matters. By understanding the dangers of overconfidence, readers can gain insights into how to approach investments with a more balanced and rational mindset.

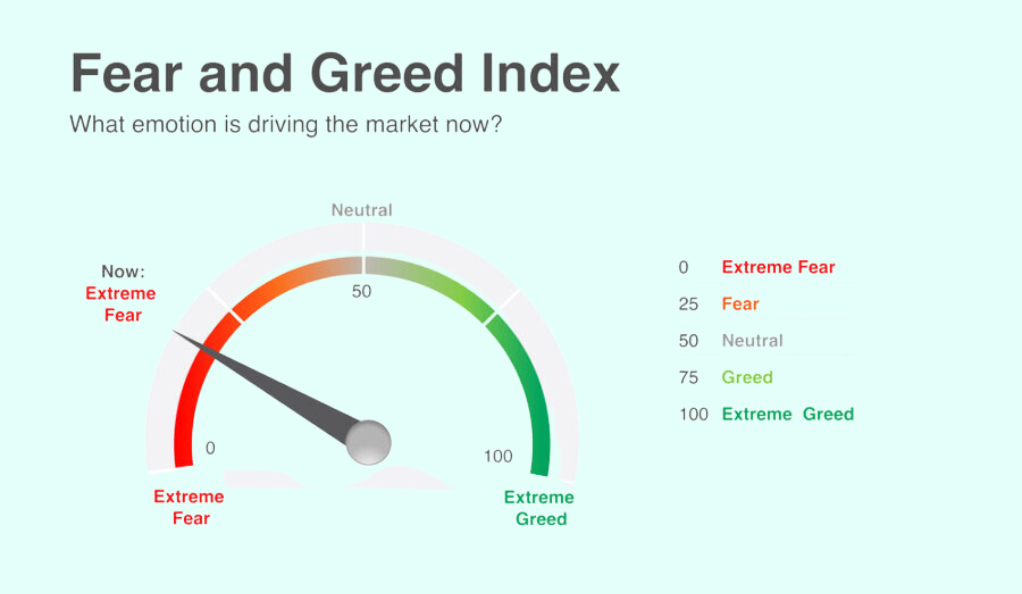

The Role of Emotions: How Fear and Greed Drive Markets

Fear: The Catalyst Behind Panics and Crashes

Fear-driven decisions can trigger market panics and crashes, causing assets to plummet beyond their fundamental values. The 2008 financial crisis serves as a stark reminder of fear’s overwhelming impact.

When faced with uncertainty or unexpected events, fear can spread rapidly throughout the market. This can lead to a herd mentality, where investors rush to sell their holdings, driving prices down further. Fear-induced panics can result in market volatility and even contribute to systemic crises.

Greed: Bubbles and Speculative Frenzies

Greed fuels bubbles, where asset prices surge to unsustainable levels driven by speculation. The dotcom bubble and the more recent cryptocurrency craze illustrate the destructive potential of greed.

Greed can lead to an exaggerated sense of optimism, with investors believing that prices will continue to rise indefinitely. This can drive demand for certain assets, causing their prices to become detached from their intrinsic value. Eventually, the bubble bursts, leading to sharp declines in prices and significant financial losses for those who bought in at the peak.

Herd Mentality: The Power of Group Influence

Herd mentality compels individuals to follow the actions of the majority, even when it defies logic. This behavior can amplify market swings and lead to collective mistakes.

Herd mentality is driven by a desire to conform and avoid feeling left out or making decisions that diverge from the crowd. This phenomenon can lead to exaggerated market movements, as individuals rush to buy or sell based on the actions of others. While herding behavior can sometimes lead to accurate responses in uncertain situations, it can also contribute to market bubbles and crashes when the majority’s actions are based on incomplete or erroneous information.

Prospect Theory: Rewriting the Rulebook of Risk

Prospect theory suggests that individuals make decisions based on perceived gains and losses rather than absolute outcomes. This theory explains why people are often risk-averse when faced with potential gains but risk-seeking in the face of losses.

According to prospect theory, people evaluate potential outcomes relative to a reference point, often the status quo. The theory proposes that individuals experience diminishing sensitivity to gains and increasing sensitivity to losses. This leads to risk-averse behavior in scenarios where gains are at stake, as individuals seek to preserve their current state. On the other hand, in scenarios involving losses, individuals become more willing to take risks in the hopes of avoiding further loss.

Limits of Rationality: Understanding Bounded Rationality

Bounded rationality acknowledges that people have cognitive limitations that prevent them from processing all available information. In finance, this can result in suboptimal choices due to information overload.

Human cognitive capacity is limited, and people often resort to using heuristics or mental shortcuts to make decisions efficiently. These shortcuts, while helpful in simplifying complex information, can also lead to errors in judgment. In financial decision-making, individuals might overlook important details or fail to consider all available options due to cognitive constraints.

Nudging for Good: Behavioral Interventions in Finance

Nudging involves designing choices to guide individuals towards better decisions. Behavioral interventions, such as default options and simplified investment choices, can help mitigate biases and improve financial outcomes.

Recognizing the presence of cognitive biases, policymakers and financial institutions can design interventions that gently guide individuals towards more rational choices. For example, default options that encourage enrollment in retirement savings plans have been successful in increasing participation rates. By aligning the default choice with the desired outcome, individuals are more likely to make decisions that are in their long-term best interest.

Case Studies: Real-World Examples of Irrational Exuberance

Dotcom Bubble: When Hopes Trumped Reality

The dotcom bubble of the late 1990s saw investors flocking to internet-related stocks, driven by unfounded optimism. When reality struck, many companies collapsed, leaving investors with massive losses.

During the dotcom era, the potential of the internet to revolutionize industries fueled an investing frenzy. Investors poured money into startups with little or no profits, driven by the belief that these companies would achieve rapid growth. However, as the bubble burst, many of these companies failed to deliver on their promises, leading to substantial financial losses for investors who had bought into the hype.

Housing Market Crash: From Boom to Bust

The housing market crash of 2008 was fueled by the belief that housing prices would keep rising indefinitely. When the bubble burst, it led to a global financial crisis and a recession.

The housing market boom leading up to 2008 was characterized by rapidly rising home prices and lax lending standards. Many investors and homeowners believed that home prices would never decline, leading to a speculative frenzy. However, when mortgage-backed securities tied to these subprime mortgages began to fail, the bubble burst, causing a ripple effect that led to the collapse of major financial institutions and a severe economic downturn.

The Future of Behavioral Finance: Trends and Challenges

As technology advances, behavioral finance gains new tools to analyze and predict human behavior in financial contexts. However, challenges like ethical concerns and data privacy must be addressed.

Advancements in artificial intelligence and machine learning enable more accurate predictions of human behavior, allowing financial professionals to anticipate market trends driven by psychological factors. However, the use of personal data for such purposes raises ethical questions about consent, privacy, and the potential for manipulation. Striking the right balance between utilizing behavioral insights and respecting individual rights remains a crucial challenge in the field.

Investor Education: Empowering Better Financial Choices

Educating investors about cognitive biases and the principles of behavioral finance can empower them to make more rational decisions and avoid common pitfalls.

Investor education plays a pivotal role in enhancing financial literacy and awareness of cognitive biases. By understanding the psychological factors that influence decision-making, individuals can become more conscious of their biases and make more informed choices. Equipped with knowledge, investors are better positioned to analyze market information critically and avoid succumbing to emotional or biased thinking.

Balancing Act: Merging Rational Analysis and Behavioral Insights

Integrating behavioral insights with traditional financial analysis can lead to more accurate predictions and better risk management.

While behavioral finance sheds light on the irrational aspects of decision-making, rational analysis remains essential for understanding economic fundamentals and market trends. Combining the two approaches allows for a more comprehensive understanding of market behavior, enabling investors to make more balanced and informed decisions.

Beyond Finance: Applications in Marketing and Economics

The concepts of behavioral finance extend beyond finance to impact marketing strategies and economic policies, as understanding consumer behavior becomes increasingly crucial.

The principles of behavioral finance have implications beyond the world of finance. In marketing, for example, understanding consumer behavior can inform product design, pricing strategies, and advertising campaigns. Similarly, policymakers can leverage insights from behavioral finance to design effective economic policies that encourage desired behaviors and discourage harmful ones.

A Holistic Approach: Psychology, Finance, and Decision Making

By recognizing the interplay between psychology and finance, individuals can make more informed choices, financial institutions can develop better products, and markets can become more stable.

Taking a holistic approach to finance involves acknowledging that humans are not purely rational beings. By integrating psychological insights into financial models, institutions can design products that align with human behavior rather than against it. This understanding can lead to improved financial well-being for individuals and a more stable and resilient financial system.

Conclusion: Embracing the Human Factor in Finance

In the world of finance, numbers tell only part of the story. Understanding the psychology behind financial decisions is essential for investors, analysts, and policymakers alike. By acknowledging and addressing the inherent irrationalities of human behavior, we can navigate the complexities of finance with greater insight and wisdom.

FAQs

While not eradicating irrationality entirely, behavioral finance raises awareness of biases. Strategies like diversification and seeking advice can mitigate their impact.

Diversify, review investments based on analysis, seek advice, set exit points, and stay informed about biases.

Yes, defaults boosting retirement savings and smaller debt repayment goals show effective behavioral interventions.

Education empowers individuals to recognize biases, think critically, and make wiser financial decisions.

Yes, understanding biases helps in budgeting, framing expenses, and using automated savings for rational financial management.